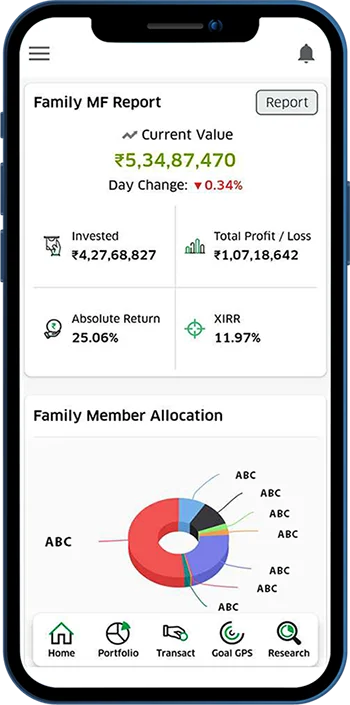

You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

About Upturn Wealth Private Limited

Your Trusted Partner in Purpose-Driven Financial Growth

At Upturn Wealth Private Limited, we’re redefining the way individuals and families experience personal finance. We believe that meaningful financial progress is rooted in clarity, trust, and a structured approach — not just in products, but in partnership.

Our system is designed to be both organized and client-centric, ensuring a smooth journey from your first interaction with us to every financial milestone along the way. Each client is paired with an experienced financial professional who offers dedicated, one-on-one guidance, helping you make well-informed decisions aligned with your goals.

We take pride in maintaining a transparent way of working — no hidden agendas, no jargon, just honest conversations and data-driven insights. Whether it's planning, investing, or reviewing progress, we ensure that you are always informed and involved.

At every stage, our focus remains on consistent, effective service, with timely updates, regular reviews, and a proactive approach to evolving needs. Our goal is simple: to help you feel confident, in control, and supported — every step of the way.

With Upturn Wealth Private Limited, you gain more than a financial advisor — you gain a reliable partner, committed to your long-term success.

Our Mission

To simplify financial planning for families through honest guidance, personalized strategies, and continuous education—helping them save better, invest smarter, and build lasting wealth.

Our Vision

To empower 1 million families to achieve financial freedom by making smart, confident, and well-informed financial decisions.

Our Values

We value trust, transparency, and integrity in everything we do. Our approach is client-first—simplifying financial planning with honest, jargon-free advice. We’re committed to educating families, focusing on long-term growth, and continuously evolving to deliver the best financial solutions for every household.

Assets Managed with Care

Investors Across India

Families on Their Financial Journey

Power of SIP

SERVICES

Financial Planning

Plan today, secure tomorrow

Financial planning helps you understand your current financial position and plan for a secure future. It includes budgeting, goal setting, and managing income, savings, and investments effectively.

Areas of Financial Planning:

- Goal-Based Planning: Set and achieve short to long-term financial goals.

- Cash Flow Management: Track income and expenses for better budgeting.

- Risk Assessment: Identify financial risks and prepare for uncertainties.

- Investment Strategy: Allocate resources wisely for optimal returns.

Key Features:

- Personalized Approach: Tailored plans based on your goals.

- Comprehensive Coverage: Includes savings, insurance, and retirement.

- Periodic Review: Adjustments made as your life evolves.

- Long-term Vision: Focuses on sustained financial well-being.

Start planning now to stay financially prepared for life’s big milestones.

Tax Planning

Save smart, grow smarter

Tax planning involves using legal methods to reduce your tax liability. It helps you optimize savings, claim deductions, and invest in tax-efficient instruments.

Popular Tax-saving Instruments:

- ELSS Funds: Equity-linked saving schemes under Section 80C.

- PPF: Public Provident Fund with long-term tax-free returns.

- NPS: National Pension System for retirement savings and tax benefits.

- Insurance Premiums: Life and health insurance offer deductions.

Key Features:

- Section 80C Benefits: Claim up to ₹1.5 lakh in deductions.

- Efficient Returns: Save tax while earning on investments.

- Compliant Methods: 100% legal and regulator-approved options.

- Year-round Support: Guidance for salaried and self-employed individuals.

Make tax planning part of your financial habit to maximize your savings.

Mutual Fund

Invest easily, diversify wisely

Mutual funds collect money from investors to invest in diversified portfolios like stocks and bonds. It’s a great way to grow wealth with the help of expert fund managers.

Types of Mutual Funds:

- Equity Funds: Invest in shares, ideal for long-term growth.

- Debt Funds: Invest in bonds and provide stable returns.

- Hybrid Funds: Combine equity and debt for balanced risk.

- Index Funds: Mirror the performance of market indices.

Key Features:

- Expert Management: Managed by professional fund managers.

- Diversification: Spread risk across multiple assets.

- Liquidity: Easily redeemable investments.

- SIP Option: Invest systematically every month.

Mutual funds make investing accessible and effective for all investor types.

Insurance

Protect your future today

Insurance is a financial tool that safeguards you and your family from unexpected risks such as illness, accidents, or loss of life. It offers financial security and peace of mind.

Types of Insurance:

- Life Insurance: Provides coverage against life risks and ensures family protection.

- Health Insurance: Covers medical expenses and hospitalization.

- Term Plans: High cover at affordable premiums for a fixed term.

- ULIPs: Combines insurance with investment options.

Key Features:

- Risk Protection: Shields your family from financial shocks.

- Tax Benefits: Premiums qualify for deductions under Section 80C and 80D.

- Customizable Plans: Choose covers based on your needs.

- Cashless Facility: Available in health insurance policies.

Insurance is not an expense, it\'s an investment in your family\'s well-being.

Fixed Deposits / Bonds

Safe and steady growth

Fixed deposits (FDs) and bonds are reliable investment options offering guaranteed returns. They are suitable for conservative investors seeking capital protection and regular income.

Types of FD/Bond Options:

- Bank FDs: Offered by banks with flexible tenures and assured returns.

- Corporate FDs: Issued by companies with slightly higher interest rates.

- Government Bonds: Backed by government, offering safety and fixed income.

- Tax Saving FDs: Provide tax deductions under Section 80C.

Key Features:

- Fixed Returns: Guaranteed interest regardless of market conditions.

- Low Risk: Suitable for risk-averse investors.

- Flexible Tenures: Choose terms ranging from months to years.

- Easy Withdrawal: Option for premature exit with minimal penalty.

Invest in FDs or bonds to balance your portfolio with stability and peace of mind.

Estate Planning

Secure your legacy

Estate planning involves organizing your assets to ensure smooth transfer to heirs while minimizing legal complications and taxes. It helps preserve your wealth for future generations.

Key Estate Planning Tools:

- Wills: Clearly define how your assets should be distributed.

- Trusts: Create legal structures for asset protection and tax efficiency.

- Nomination: Assign rightful beneficiaries to your financial instruments.

- Power of Attorney: Authorize someone to make decisions on your behalf.

Key Features:

- Asset Protection: Prevents legal disputes among heirs.

- Tax Efficiency: Helps reduce inheritance-related tax burdens.

- Continuity: Ensures smooth transfer of ownership.

- Family Peace: Reduces future stress and conflict.

Plan your estate today to protect your legacy and provide for your loved ones.

Tools

Testimonials

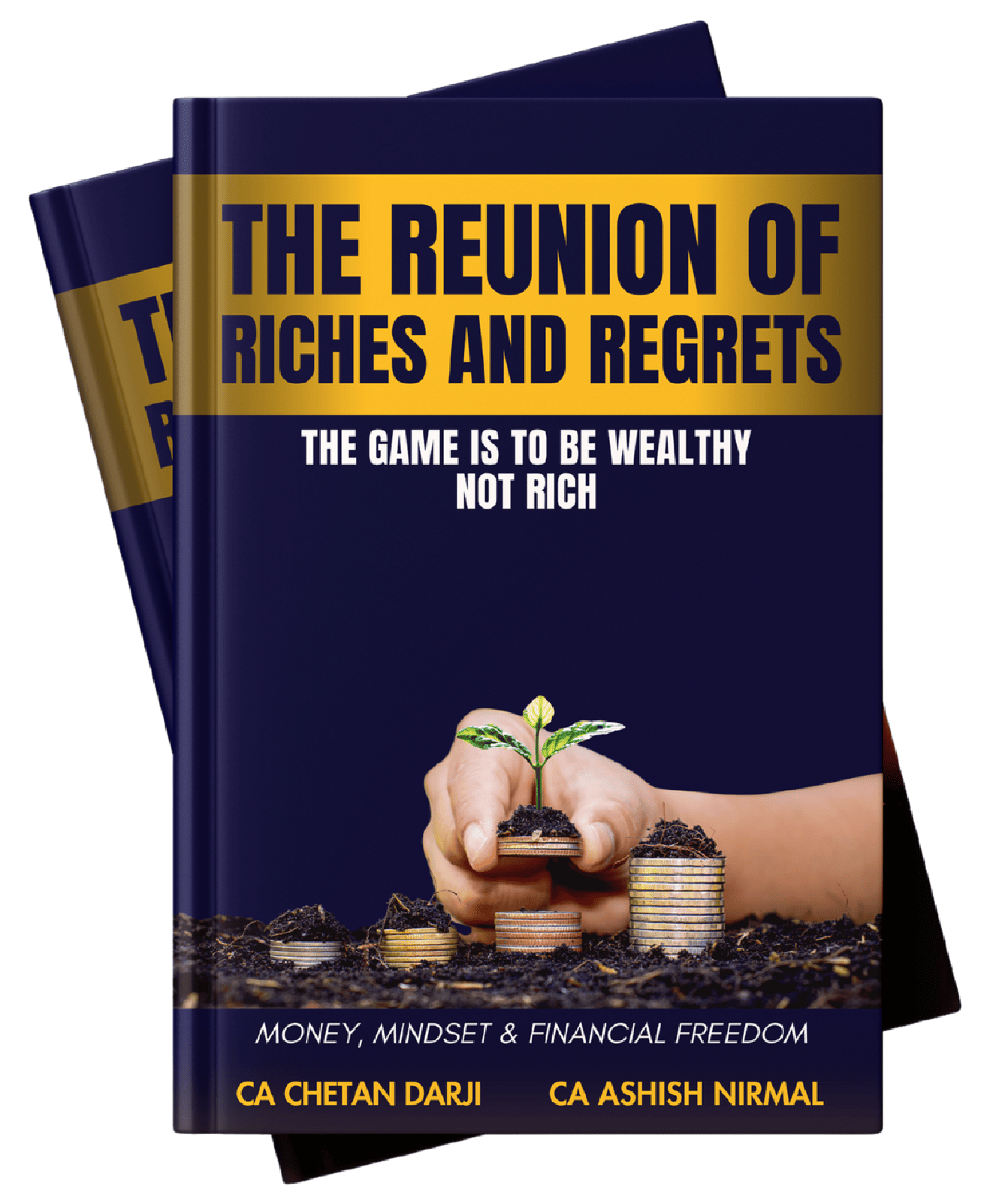

Unlock Financial Freedom

Your essential guide to smarter investments and secure future planning

Discover actionable insights, proven strategies, and expert advice in this comprehensive guide. Whether you're starting out or refining your investment journey, this book will empower you to make confident, informed decisions.

Teams

CA Ashish Nirmal

Managing Director

CA Kirit Darji

Director

CA Chetan Darji

Expert

Mr. Suraj Rathod

CEOOur Features

-

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.